What is an SA109 form?

The SA109 is a supplementary tax form for filing the residence and remittance basis tax pages of your Self Assessment.

Who needs to file SA109 form?

You will need to fill out an SA109 if you are:

- a non-UK resident

- not ordinarily resident or not domiciled in the UK

- classed as a dual resident in the UK and another country

What information do you need to provide?

The SA109 form is for people who don’t live in the UK but earn money there. They need to fill in what kind of money they made, how much, and any tax breaks they can get.

The form also asks where they live and how long they were in the UK during the tax year.

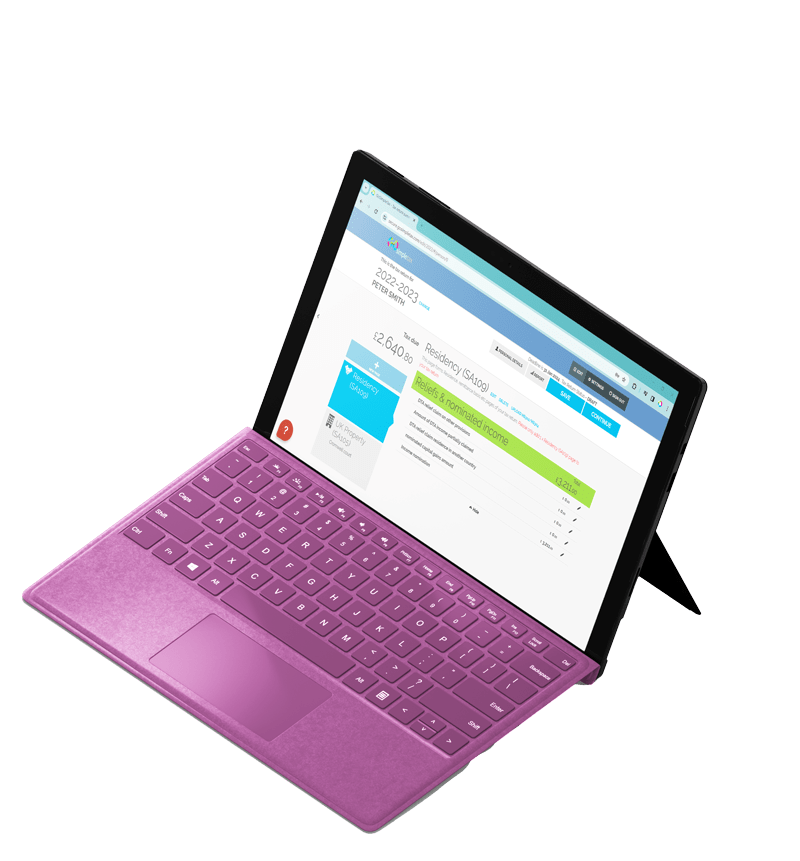

How GoSimpleTax can help you?

Direct Submission To HMRC

Save time by submitting information directly to HMRC.

You cannot file a SA109 using HMRC’s online system but that is something we can help with.

Support and Guidance

Ease your tax return process with our software, featuring step-by-step guidance from a team of former HMRC employees.

Established in 2013 with over 100,000 successful submissions.

Automated Calculations

We streamline the tax return process by automatically calculating tax dues. This way there is a lower chance of errors in your tax return.

Tax-Saving Tips

We offer guidance on how to legally reduce tax liabilities. With our help you are likely to pay less tax on your earnings.

Start your tax return now

Do yourself a favour this tax season – give GoSimpleTax a try, and save hours of valuable time with our easy-to-use tax return software.